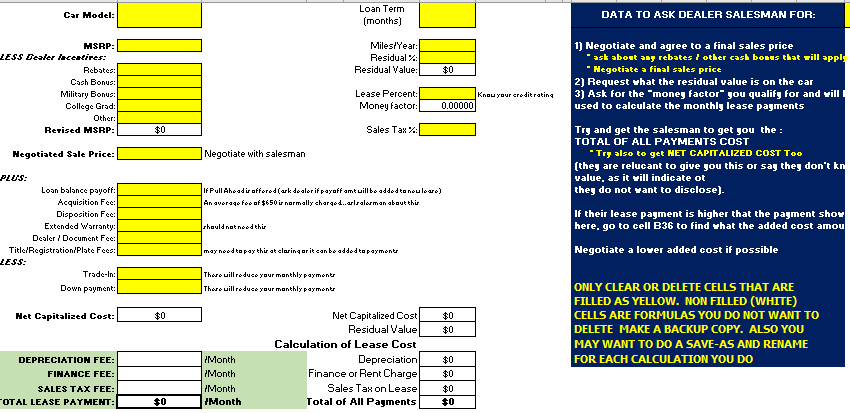

By most estimates, cars depreciate by about 20% in their first year of ownership and lose about 60% of their value within the first five years. DepreciationĬars lose their value the minute they are put into use, thanks to the wear and tear, and the fact that newer models and better technology make older vehicles less valuable. Lenders will estimate how much your car is worth by the time you’re done with it to calculate your overall lease value. Residual ValueĪ car’s residual value is what it’s expected to be worth at the end of the lease term. The money factor is negotiable, but it’s also based on things that lenders care about, like your credit score. The money factor is usually shown as a very small number starting with a decimal point-say 0.00167, which would equate to 4% (2,400 x 0.00167). As a rough rule of thumb, if you multiply the money factor by 2,400, you’ll get the equivalent annual percentage rate (APR), which is a better-understood way of expressing the overall cost of financing. Money FactorĪ car lease’s money factor is the financing charges you’ll pay. Here are key terms you will need to know when seeking an auto lease. However, it’s important to point out that there will always be fees associated with any lease, which vary from seller to seller. There are many variables in any car lease, but the most important ones are the current price of the car, its estimated value at the end of the lease, how long the lease will last and the interest rate. On Consumers Credit Union's Website How Is an Auto Lease Payment Calculated?

0 kommentar(er)

0 kommentar(er)